Atlantis Capital is committed to assisting you and your business survive, expand, and thrive in today’s increasingly competitive environment. We know that you need cash— it’s essential to keep a business operating. Sometimes, costs pile up and direct action is required. However, many banks don’t lend to businesses that aren’t already booming. What can be done?

- The money Atlantis Capital can put into your businesses’ account can come in several different forms; the most common way for us to give you money is through a Merchant Cash Advance.

- This type of transaction can give your business a secure, fast, and reliable source of cash with quick approval, but it is not a loan. This kind of financial services transaction is actually a sale. Merchant Cash Advances differ in several key ways from loans:

How to get cash : Merchant Cash Advance

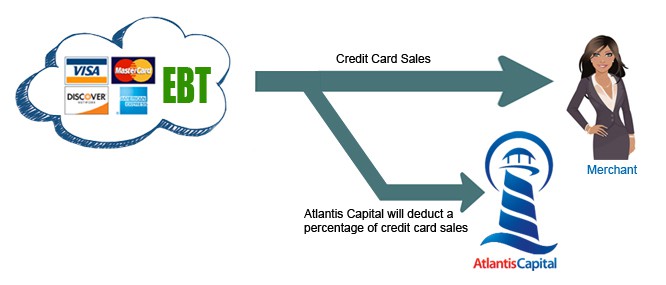

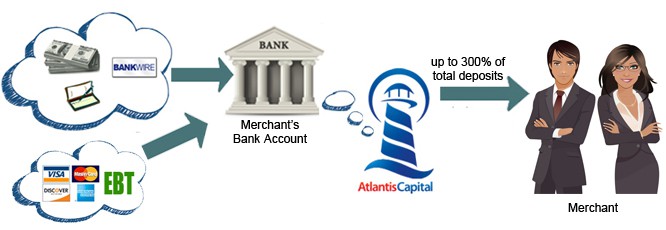

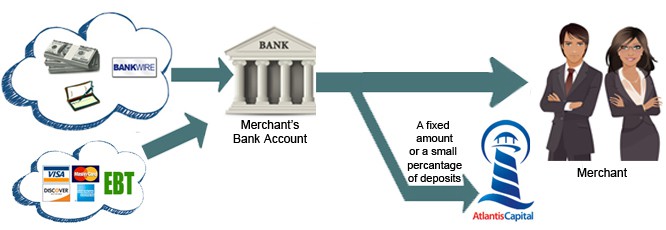

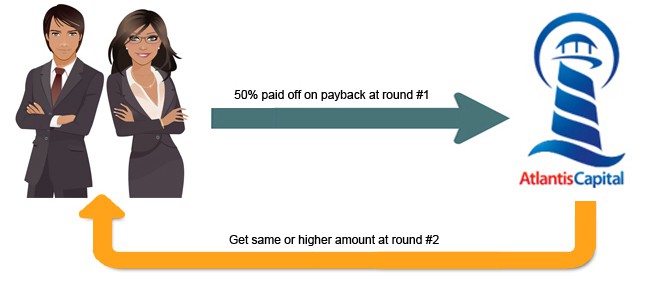

Our clients agree to sell Atlantis Capital their future transactions at a discount in order to quickly get an influx of money. Generally, these future transactions are going to be credit card deposits or sales, but there are a number of different ways to facilitate the transaction so that it works for all parties. The funds we advance your business are paid back by percentages of your future sales. The rate at which Atlantis Capital is paid back is one which both parties agree on from the start; unlike most types of loans, this sort of financial services sale has no minimum monthly payment or anything of the sort.

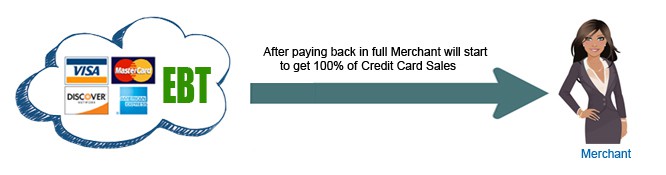

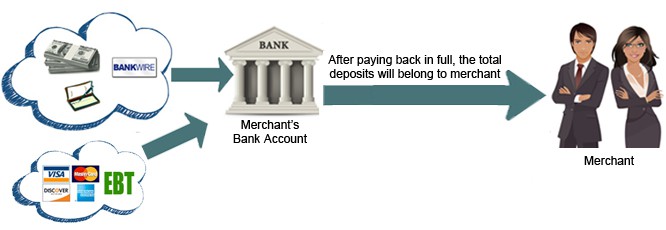

Once the money provided by Atlantis Capital is paid off, your businesses’ credit card transactions go back to 100%; everything remains as it was but you then owe us nothing and have a higher rate of return from your sales.

How to Get Cash: Bank-Only ACH Programs

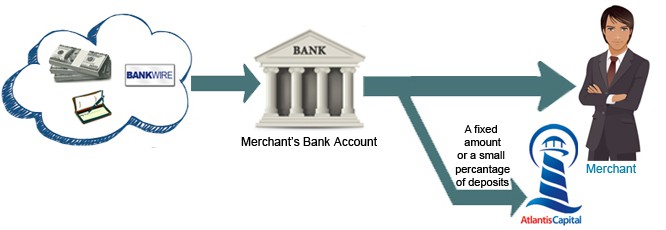

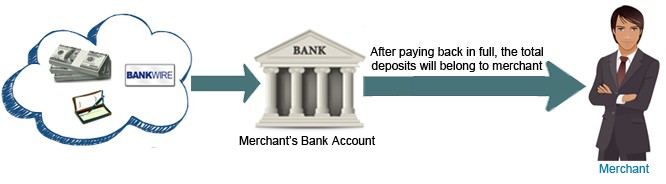

Even if your business doesn’t process credit cards, there are other ways for Atlantis Capital to assist your company with a direct infusion of cash. If a Merchant Cash Advance isn’t right for you, Atlantis Capital also offers a comprehensive “Bank Only ACH Program” for businesses which perhaps don’t use credit cards to the volume needed to be effective for a Merchant Cash Advance. This second method is driven by the total gross income as shown by bank account deposits— once this is assessed, then an ACH mechanism manages the payback. This safe, efficient method of giving your business cash protects both sides and provides you and your business with the certainty you need about your cash flow. As with the Merchant Cash Advance, once the ACH program advance is paid off, your business goes back to collecting 100% of your sales— nothing changes except your business is even more efficient financially.

At Atlantis Capital, we always make sure that our clients understand the exact terms of our Merchant Cash Advance and ACH advance programs; if you or your company has any questions about the process which aren’t answered in our comprehensive information pages or our FAQ, please call one of our professional representatives at 877-364-5227 and we’ll be delighted to assist you with your situation.

Loan alternatives program: